SHILLONG, AUG 31: The state cabinet approved the Meghalaya Value Added Tax (VAT) Act to ensure revenue realisation from sale of coal and limestone to private cement factories and other industries.

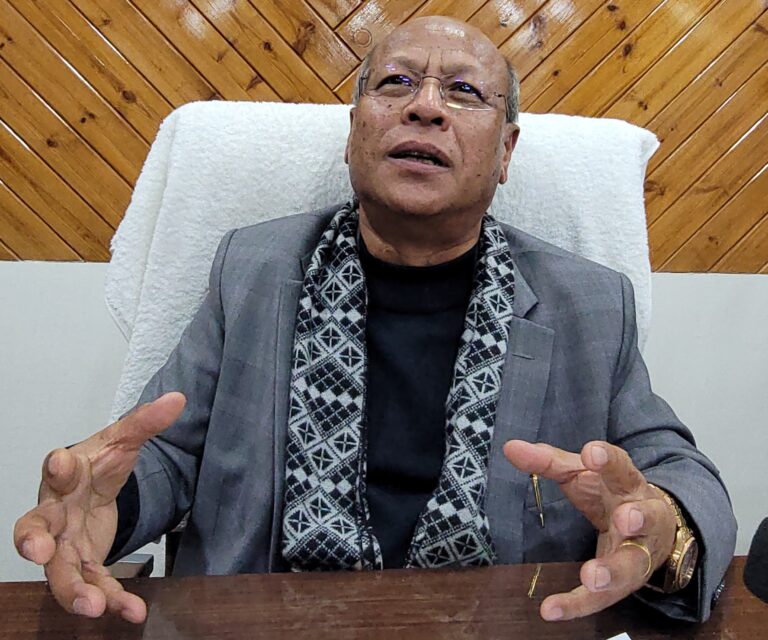

“We have approved the amendment of the Section 106 of the MVAT, Act, which is in relation to the mechanism for realization of MVAT from various companies both private and public limited companies who are engaged in procurement and purchase,” chief minister Mukul Sangma told newsmen on Monday.

According to him, any of the private owned industries, private limited companies industries who purchase procurement and therefore there is an instance of sale and purchase taking place the relevant portion of the MVAT will apply.

However, the department has been finding it difficult to actually enforce this particular MVAT of various sales being made by the dealers such as coal and limestone to the factories – cement and other industries.

He informed that this particular proposal is specific to the supply and sale of limestone and coal to private cement plants and other private industries which invoke this tax to be deducted at source. He said when these companies are paying credit to the suppliers they will be required to deduct the prescribed amount as MVAT and follow the prescribe rule which is to be deducted at source.- By Our Reporter

+ There are no comments

Add yours